Everybody in the change business knows about these clashes when new ideas take on old belief systems. Currently, there is an epic clash of fundamentals developing in the financial world!

A new belief system usually arises when a few people start investigating flaws in the current way of operating. They may discover there is something fundamentally wrong which causes unwanted effects that keep persisting. With proper problem-solving skills, these investigators may come up with new ways of operating based on some new fundamentals.

This is exactly what is happening in the financial world right now.

Please note: I am not a financial advisor nor is this financial advice!

One still brewing is the battle against the manipulation of silver. Look for #silversqueeze if you want to learn more. Another battle is already playing out.

$AMC and $GME

Gamestop Corporation and AMC Entertainment Holdings, Inc. are two examples of stocks that demonstrate a fundamental change. A change that started to show at the beginning of this year.

Before, these stocks were valued based on the perceived fundamentals of their business: sales, costs, profit, cash flow, etcetera. Based on these fundamentals, both stocks were valued at around or below five dollars.

Now Gamestop is valued at over $200 and AMC is valued at over $50. Did the fundamentals of these businesses change with 1000% or 4000%? Of course not.

What changed is the fundamentals of valuation.

What these “meme” stocks are currently exposing is an evil practice in the options market.

Hedge funds were betting against these companies, taking short positions in anticipation of bankruptcy of these companies. And by doing so these Hedge funds even tried to accelerate this bankruptcy which would put tens of thousands of Mainstreet people into unemployment.

Wallstreet does not care about (unemployed) people.

Wallstreet cares about profit.

To accelerate bankruptcy, which would bring Hedge funds tremendous profits, they kept shorting and shorting and shorting these stocks. Until they went too far…

What happened is that they took more short positions than that there are stocks available to close them with.

That was the chance to expose this evil practice!

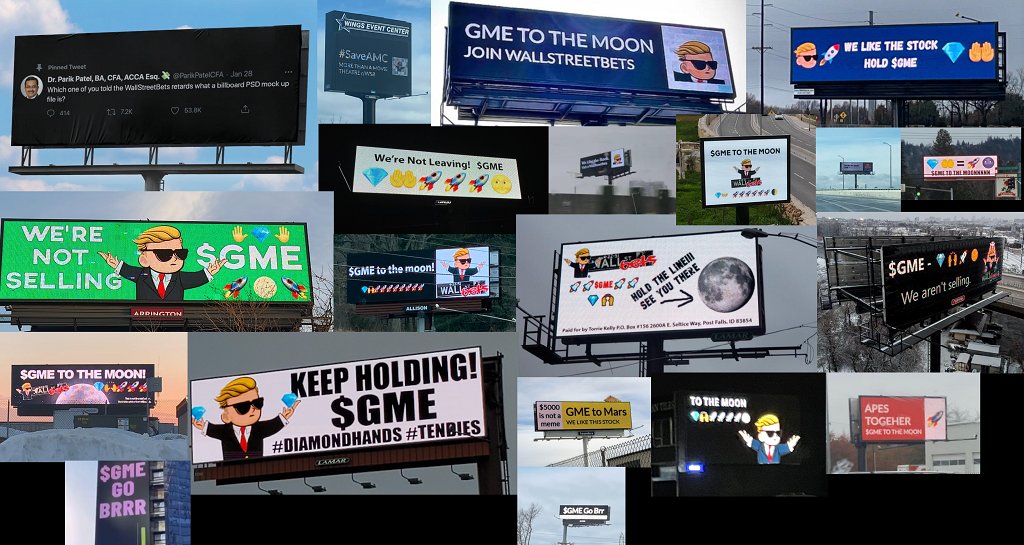

Millions of Mainstreet people took on the battle against this, decennia long, Wallstreet practice and started buying these stocks. Now these “Apes” hold just about all the available stocks. Stocks the Hedge funds need, to close their short positions.

So, the value of these stocks has currently nothing to do with the fundamentals of their business.

Now the value of these stocks has everything to do with the price that Hedge funds will be willing to pay to be able to close their short positions. And because there are more short positions to close than that there are stocks to close them with, theoretically, the value of these stocks is infinite.

Currently, the Hedge funds are losing hundreds of millions PER DAY because they fail to deliver the stocks they borrowed for their short positions. The Hedge funds can only stop this bleeding by buying stocks from the Apes.

These Apes are so sick of this evil practice, that has caused so much misery for Mainstreet people during the past decades, that they decided to HODL (hold on for dear life) these stocks with “diamond hands” until the Hedge funds are willing to pay a preset price.

Some have their price target at $10.000.

Some have their price target at $100.000.

And some even higher…

Leave a Reply